July is National Savings Month, a campaign initiated by the South African Savings Institute (SASI) to encourage South Africans to focus on alternative savings solutions. The nationwide Covid-19 lockdowns this past year dealt a hard blow to many people financially, but that doesn’t mean you should give up on your financial goals. Now is a great time to re-evaluate your budget and start saving.

One of the smartest ways to save and grow your money is to invest, and property remains a safe and reliable investment in times of uncertainty. Creating wealth is the ultimate money goal, but it all starts with saving. By saving, you’ll be in a better position to own property, and use that property to create wealth.

So, when is the best time to start investing in property? According to Andrea Tucker, Director of Mortgage Me, the younger you are when you buy your first home, the quicker you can pay your property off, and the sooner you will be debt-free (or at the point where you can upgrade to a bigger property).

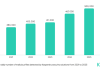

The average age of South Africans who are investing in property for the first time, though, is older than we think. “This is due to the earning demographics in this country, and the large, growing middle class. The average age of a first time South African home buyer oscillates between 35 and 40 annually,” Andrea says. Circumstances that have contributed to the increased age of first-time homebuyers include slow economic growth and high unemployment rates, the desire to travel and choose experiences over stability and security, the high price of deposits and house price increases.

“The question of when the best time is to invest in property is a tricky one. I believe that as soon as you can afford all the costs it is time to take the plunge,” says Andrea. Here is her advice on what to consider before you commit:

- Are you financially secure? You should have a good handle on your expenses and your salary should be stable.

- Are you able to save regularly? You will need to do this for a deposit against a property and have funds available for the additional costs that come with taking ownership of a property, for example transfer fees and bond costs.

- Are you ready to settle and put down roots? Many financial experts suggest that for your purchase to make financial sense, you should plan on staying put for at least five years.

- Are you certain about what you want? Think about the distance to work, family needs, locations of schools etc.

- Are you aware of the costs and challenges of owning your own property? Owning a home involves maintenance, insurance and garden services, among other things. You can’t rely on a landlord to fix things that break.

- Are you happy with paying off a home? You will be owning an asset that may only give you a return on your investment in a few years’ time – either because it has increased in value, or you have been able to pay it off faster than anticipated.

- Are you happy with the price of properties in the areas you like? Consider what value you are getting for the money you are investing and ensure that the areas you are hoping to live in are holding their property values.

- Are you willing to use cash windfalls wisely? This may mean using any bonuses received to pay off your bond more quickly rather than, for instance, buying a new car for a few years.

If your answers to these questions are ‘yes’, then it is probably a good time for you to start property hunting. Keep in mind that having a monthly budget and sticking to it will ensure you start your home ownership journey off on the right foot.