MasterCard has partnered Vodacom and BancABC to introduce the first online card in Tanzania – the M-Pesa virtual card.

According to Hisham Hendi, Vodacom Tanzania PLC’s Acting Managing Director, Vodacom’s M-Pesa is already an industry trailblazer with over 8.2 million subscribers and over 100,000 agents countrywide that enable citizens to transact safely and easily, but customers are limited when it comes to making online payments on international websites.

The introduction of this functionality through the M-Pesa virtual card will revolutionize how people transact by removing the barrier of having bank accounts and risk of putting bank details online.

Africa’s mobile internet connections are expected to grow rapidly due to affordable smartphones and high-speed networks being rolled out by Mobile Network Operators like Vodacom. This surge in internet connections will create a demand for digital content, social media, m-commerce and even online education and a need to make payments easily and securely.

The virtual card will allow M-Pesa mobile wallet holders to make payments on any local or international website or app so long as Mastercard is accepted for payment without the need for a bank account or credit card. Customers can request the virtual card from the M-Pesa USSD menu or soon on the M-Pesa app and top the card up via the wallet. Once the card is topped up with funds, the virtual card is ready for use.

“The continued roll-out of innovative technology solutions in the e-commerce space represents an opportunity for greater financial inclusion and means that more people will be able to make payments, without the inconvenience of cash. With 60 per cent of these transactions happening on mobile platforms, the future of financial inclusion undoubtedly lies in the mobile device that most of us carry around with us,” says Raghav Prasad, Division President Sub Saharan Africa, Mastercard.

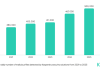

Simple and secure online payments have been proven to improve access to financial services, widely allowing more people to become part of the financial mainstream. Tanzania has made great strides in financially including its citizens in the past decade: the percentage of Tanzanians forming part of the economy sat at only 15.8 per cent in 2009 but that number jumped to 65.3 per cent in 2017, driven largely by the introduction of easily accessible mobile wallet solutions like M-Pesa.

Collaboration between industry leaders in payments, technology and financial services means life-changing solutions can be developed and rolled out rapidly to make a tangible difference in the lives of Tanzanians by allowing them to buy and pay for goods and services more easily than ever before.