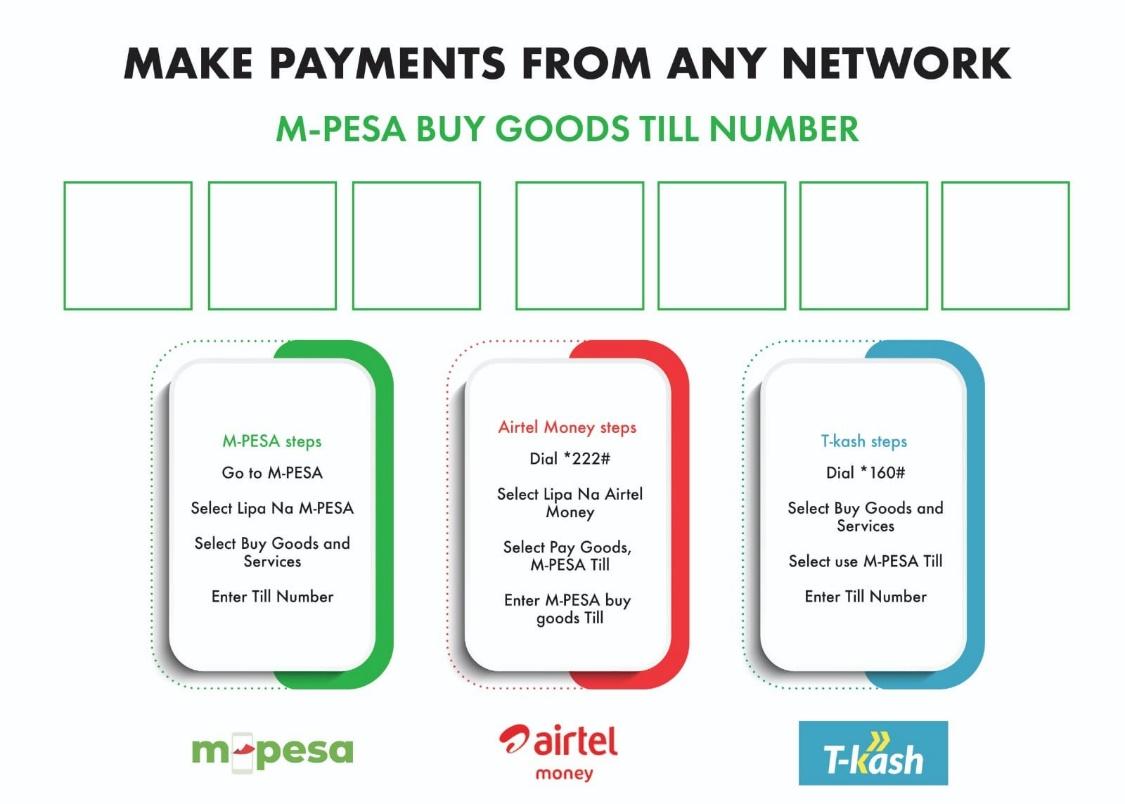

Telkom, Safaricom, and Airtel have announced the interoperability of their mobile money service platforms, allowing Kenyans to make mobile money payments to a Lipa Na M-PESA Buy Goods Till, from any of the three networks. The service will exclusively apply to Lipa Na M-PESA Buy Goods and excludes PayBills.

This is the first phase towards complete Merchant Interoperability, whose objective is to enable customers from the three mobile money service platforms: T-Kash, M-PESA, and Airtel Money, to make direct mobile money payments to any merchant till number across all networks, boosting the adoption and convenience of making cashless payments.

This proposition is also in line with the principles of the National Payments Strategy, 2022 – 2025, which was launched by the Central Bank of Kenya in February this year.

Telkom, Safaricom and Airtel integrate Mobile Money Services

This is the first phase of Merchant Interoperability, allowing Kenyans to make mobile money payments to an M-PESA Buy Goods Till from any network

Telkom Kenya’s CEO, Mugo KIBATI says:

“Kenya remains a global leader in the adoption of mobile money, with transactions in the billions of shillings reflecting the evolving customer demand for secure transactions. Our mobile money service, T-Kash, is the culmination of extensive research on evolving customer demands, such as the need for security, simplicity, availability and a diversified service offering. In addition to enriching our financial service offering, the introduction of merchant interoperability brings us closer to realising a cashless economy, further enhancing a seamless digital transactions ecosystem that gives the consumer more choice.”

Safaricom’s CEO, Peter NDEGWA, says:

“Safaricom is delighted to partner with other industry players on this exciting innovation to empower mobile money customers in the country to make payments through Lipa Na M-PESA. This partnership builds on the successful rollout of mobile money interoperability, making it possible for customers to send and receive money from any network in the country.”

Airtel Kenya CEO Prasanta Das SARMA says:

“I am delighted to see Kenya take this big step to enable customers to make payments to mobile money merchants, irrespective of their mobile money provider. Our customers will also experience a dynamic, secure, convenient, and more affordable digital payment ecosystem for personal and business payments.”

Telkom, Safaricom, and Airtel are confident that this solution will offer a faster, more affordable, secure, and convenient alternative to cash payments and eliminate the hassle of transferring money across networks before making payments.

The customer journey is illustrated here: