The FinTech Association of Nigeria (FintechNGR) has launched a new platform designed to provide fintech start-ups with access to free and heavily discounted services in funding, legal, infrastructure, cybersecurity, data privacy, business development, and a variety of other areas. Tagged, The Start-Up Marketplace, the platform was created to accelerate the growth of fintech start-ups.

The President, FinTechNGR and the Executive Director, Information Technology and Operations at Access Bank Plc, Ade Bajomo, affirmed that, “The Start-Up Marketplace will aid in the development and deepening of Nigeria’s FinTech talent pool. He made the affirmation while announcing the development at the association’s first conference of the year, tagged ‘Fintech Outlook 2022’,

“The platform will also encourage research and development to get innovators and start-ups on a higher plane, foster an environment of supportive regulation to grow the industry, facilitate local investors to participate in the funding of FinTechs and position local start-ups and innovators to build and develop durable and strategic intellectual properties.”

According to Bajomo, the COVID-19 pandemic resulted in a challenging year for businesses globally. Despite this, start-ups in the most powerful economies in Africa have continued to grow and show great potential, becoming increasingly significant in the new normal.

The increased rate of investment in Fintech start-ups, according to him, showed how much the industry has caught the attention of investors and Venture Capitalists, who see the industry’s potential for growth and resilience.

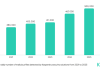

In Africa, FinTechs dominated fundraising, accounting for close to $3 billion of the nearly $5 billion raised by African tech start-ups in 2021. He added that in the same year, Nigerian start-ups raised $1.09 billion, representing 73.5 per cent of the $1.37 billion raised by start-ups, he added.

Stating reasons for the increased interest, Head of the Africa Fintech Foundry, Daniel Awe, identified heightened innovation as a key driver. “We are already beginning to see FinTechs innovate across Greentech, Digital Insurance, blockchain, financial inclusion, amongst others. That said, we need to continue creating strategic partnerships with other players in the ecosystem through which game-changing innovative solutions can be formed and new potentials can be discovered enabling growth, customer satisfaction, and improved business practices. The Foundry is contributing to this development by creating ventures that can compete in various industry verticals by providing new and improved digital products to end-users thereby enabling opportunities in new markets to be developed.”

In addition to key industry presentations, the virtual event also unearthed trends, and forecasts across FinTech verticals; lending, payment, mobile money, banking, infrastructure, regulation, partnerships, skillsets, wealthtech, insurtech, cybersecurity, data privacy, open banking, decentralised finance and other areas.