Telkom Kenya and Lipa Later have created a partnership that will see Telkom give Kenyans access to smart mobile devices through a product financing solution that will let them pay later in instalments.

With this partnership, both companies are looking to make these devices more accessible to consumers through affordable monthly instalments. 12 months. Consumers will be able to access select phones from brands such as iPhone, Nokia, Oppo, Realme, Tecno, Ulefone, Vivo, Xiaomi, Huawei, Bontel and Itel.

The uptake of smartphones continues to grow with more people getting to appreciate the advantages of having access to the Internet in the palm of their hand. This partnership blends with Telkom’s vision of empowering its customers to access mobile and data services.

According to the Global Systems for Mobile Communications Association (GSMA), there is ample opportunity for the mobile industry and ecosystem players to improve smartphone affordability among these consumer segments

Speaking on the partnership, Telkom CEO, Mugo Kibati said “Telkom is excited to announce this partnership as it speaks to our belief that access to Mobile Data is a fundamental human right. This is due to its strategic potential to progressively address digital inclusion; ensuring the benefits of the Internet and digital technologies are available to more Kenyans, consequently empowering the digital economy.”

“Telkom remains committed to enabling Kenyans to be part of an interconnected world. We continue to have exploratory discussions with our partners to find solutions that will enable our customers to have access to a wide range of authentic products and services, affordably and conveniently. Coupled with the easier access to smart mobile devices through this partnership with Lipa Later, our customers will also be able to enjoy affordable Mobile Data through our products such as the recently launched Changa Bundle which enables Kenyans to share data, minutes, voice and SMSs.” he added.

Lipa Later CEO, Eric Muli says “We are delighted to kick start this partnership with Telkom that will enable both our customers to get and stay connected by acquiring mobile and data devices affordably. Consumers can walk into any Telkom store, sign up with Lipa Later, get a credit limit in less than 5 minutes, pick a device of their choice at zero deposit, get connected to mobile and data services, and pay for the same in up to 12 monthly instalments.”

“Additionally with our integration with UzaPoint, the process at the checkout till will be seamless for the consumer across all the Telkom outlets in the country,” he adds.

Curious about how Lipa later works especially on full product recovery? We had a chat with the CEO and this is what he had to say, “we have a binding e-contract with our customers which we ensure they agree to before we complete the transactions. By the time they’ve left the office/store, we have settled on how the payment will be made and for how long, which has helped us minimize loan defaults. “

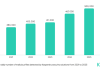

The Global Buy Now Pay Later industry’s market size was valued at $90.69 Billion in 2020 and is projected to reach $3.98 Trillion by 2030, growing at a compound annual growth rate of 45.7% from 2021 to 2030.

More retailers are also coming on board to offer Buy Now Pay Later solutions that enable their customers to purchase essential goods by choosing an affordable financing plan and paying in instalments instead of the entire cost all at once.

The increase in the adoption of online payment methods across developing nations is also accelerating the growth of the buy now pay later payment market.