Visa and mobile financial services firm Branch have signed a deal that will see Branch offer custom financing to merchants who accept payment via Visa (Visa on mobile or Card). The loans will provide merchants with funds to grow their business through supplemental stock, infrastructure investment, and other key operational needs. Loans will be disbursed directly to the merchants’ phones.

According to Visa General Manager for East Africa, Sunny Walia, Visa is happy to work with Branch to offer seamless access to finance through its Visa network, as Branch seeks to provide micro-credit facilities to merchants across Kenya.

“With this partnership, we seek to offer value beyond just transactions. We would like to help the merchants grow their business and drive financial inclusion among the small merchant segments that are often unable to access quick loans,” he said.

Through this partnership, Visa and Branch aim to significantly reduce the cost of cash for these merchants. The eligible merchants will be able to access loans of up to KSh30, 000 ($300) which can be repaid within 6 months.

“Visa revolutionized the payments technology space and popularized the idea of the credit card to the world,” said Branch CEO Matthew Flannery. “At Branch, we think mobile financial apps are the ‘cards’ of the future. It only makes sense to be working together to bring world-class financial services to merchants here in Kenya and beyond.”

Branch is a machine learning-powered provider of mobile financial products across Africa and Latin America, with plans to expand to Asia. Branch helps unlock financial access for billions of people around the world and is currently the most popular financial app in Africa.

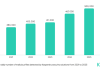

In emerging markets across the globe, there is an expanding need for fair, reliable financial services and capital. With smartphone growth usage at an all-time high, Branch has a unique opportunity to build customer-first financial products for people worldwide.