The slight ease in headline inflation over the past few months, driven mainly by slightly reduced fuel costs, masks a rampant inflationary environment for South African consumers that disproportionately impacts lower-income households.

When inflation rises the purchasing power of money decreases, meaning that each rand can buy fewer goods and services than before. This can have a disproportionate impact on blue-collar workers, who typically have lower incomes and may struggle to keep up with rising prices.

Blue-collar workers often spend a higher proportion of their income on necessities such as food, housing, and transportation. These are the types of goods and services that tend to experience the most significant price increases during periods of inflation, which means that blue-collar workers may feel the effects more acutely.

Consumer-price-index (CPI) data from StatsSA showed food price inflation hitting a 14-year high in January 2023. The Bureau for Food and Agricultural Policy notes several factors influencing food-price inflation, including; a weak rand which affects food imports, persistent and escalating loadshedding which raises the costs of production, the war in Ukraine, and supply-chain disruptions.

Inflation acts on household budgets much like a regressive tax would. Regressive taxes are taxes that have a greater impact on poor households than on wealthier ones. They are generally considered immoral and economically damaging- but that’s exactly the effect we’re seeing with high inflation.

Inflation cuts into wages, erodes purchasing power, and increases pressure on an already besieged workforce. Inflation is a burden on everyone, but it’s a burden that is much easier to bear if you have the flexibility to choose how to spend your income.

If you’re able to reduce the cost of your groceries each month by choosing to forego luxuries and seek out specials, you may be able to keep spending in check. But there’s little flexibility at a lower income level to adjust the groceries that go into your basket. Whatever staples cost, you have to buy them.

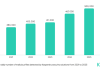

This is borne out by a recent report from Discovery Bank and Visa on consumer spending trends in South Africa. The report found that lower-income clients were spending 47% more on groceries today than they did in 2019 – this excludes cash based purchases. This extra spending doesn’t come out of discretionary income – it eats into budgets that might otherwise go into savings, education or starting small businesses.

It also puts blue-collar workers under extreme mental and emotional pressure. Being the sole breadwinner for a family is never easy, and it has gotten a lot harder over the past year.

Additionally, blue-collar workers have traditionally been less likely to have access to financial tools that can help offset the effects of inflation, although this is starting to change.

Earned-wage access (EWA) solutions are one such tool. EWA solutions aim to ease the burden on workers by allowing them to draw a portion from their already earned wages when they need to, avoiding the necessity to seek high-interest, short-term loans.

The EWA sector is growing rapidly globally, but there are few EWA providers in Africa, where the potential positive impact is arguably greatest. Paymenow is one of the few EWA providers in Southern Africa that focuses on promoting responsible usage through gamified financial education, and is also the first EWA provider to have expanded into Namibia and Zambia, with additional expansion planned for the continent.

The demand for EWA services is high, and the impact is already tangible. In third-party research conducted for Paymenow, almost all customers reported an improvement in their overall quality of life as a result of using the service, and nearly two thirds reported significant improvements.

Four in five customers said their ability to save had improved, meaning they had more cash in hand for emergencies and were able to reduce borrowing from high-interest-rate lenders.

With the major identified factors causing high food prices being the weak rand and loadshedding, it is unlikely that inflationary pressures will ease up anytime soon, and while they persist, poor and lower-income households will continue to suffer.

Fortunately, there are innovative solutions available to ease this burden. Earned-wage access has the potential to reduce or alleviate payday stress on working-class South Africans, and empower them to take control of their finances in a difficult economic environment.