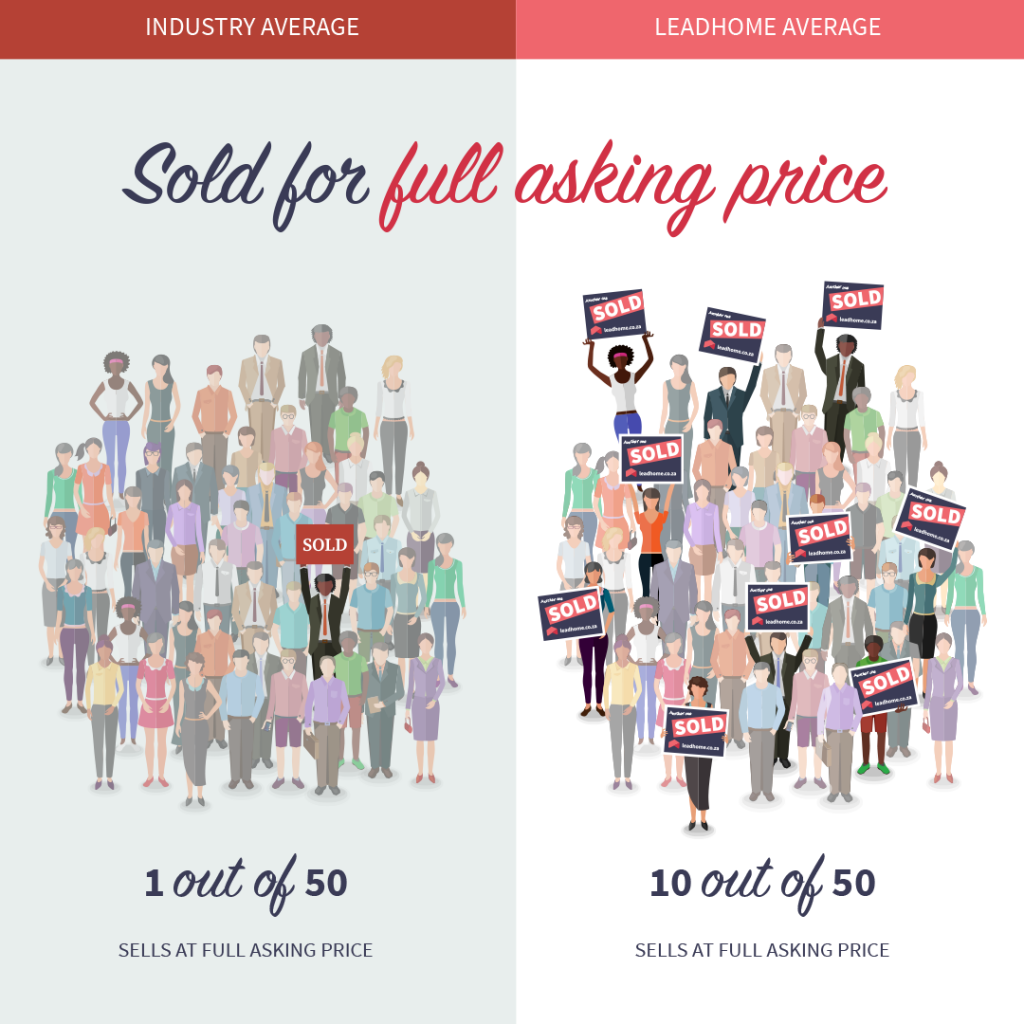

Business Insider, in July 2019, reported that only two per cent of houses were being sold at the asking price. In less than four months since then, real estate disruptor, Leadhome says that at least one in every five of its properties are sold at listing price or above: “In a struggling economy, to sell 20% of our listings at asking price or above is significant. On average, the remaining 80% sell for 5,7% less than expected. This might not sound all that impressive, but in fact when compared to the FNB property barometer released in July 2019, only 2% of South African home sellers received their initial asking price and 98% had to drop their price by 9.9% on average. This, in our view, means that the Leadhome methodology and approach is working well, ultimately ensuring we achieve our customer-centricity goal by increasing the chances of the best price,” says Marcél du Toit, CEO, Leadhome.

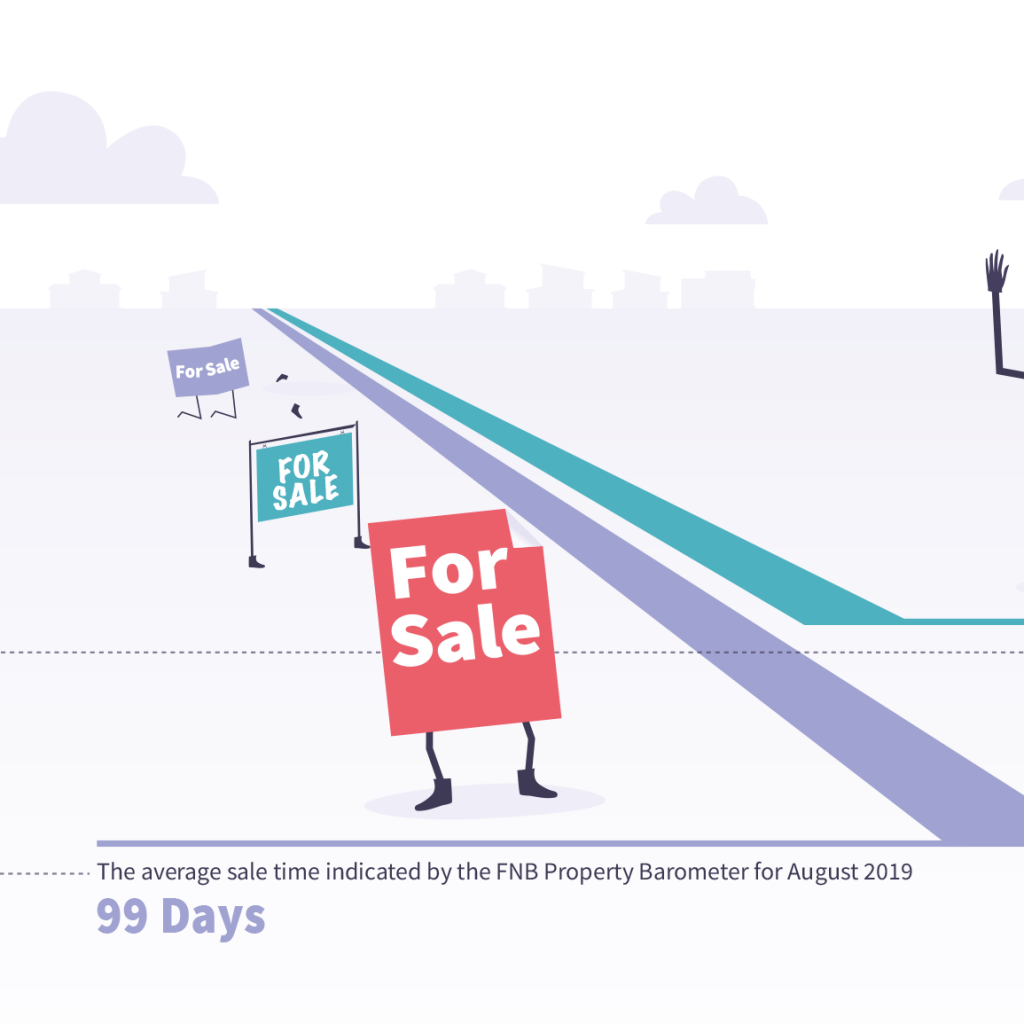

In addition, Du Toit says that Leadhome also sells homes on average 31% faster than its competitors: “The Leadhome ‘speed’ is something that has been cultivated since our inception four years ago. With a focus on best service, our client insights and approach has ensured that we are not only able to successfully sell homes, but in a national average sales time of just 68 days. When compared against 99 days, as indicated by the FNB Barometer for Q2 2019.”

According to the latest FNB Market Strength Index (a composite index, which gauges demand and supply strength), a narrowing demand-supply gap over the past few months is becoming evident. This is on the back of both the mild improvement in demand, and the persistently slowing pace at which properties enter the market for resale. This is countered somewhat by the surge in the supply of new stock (particularly flats and townhouses), as well as the rising emigration-related sales. Trends show the number of houses for sale is increasing, but the sales cycle is taking longer, and homeowners can expect to have to lower their prices.

The FNB Barometer Report found that the view of a supply-demand imbalance was supported by a marginal rise, from 95.3% to 98% in the second quarter, in the percentage of sellers having to drop their asking price. Furthermore, the average price drop edged up moderately to 9.9%, above the historical average of approximately 9.0% since 2010, all consistent with a market in favour of buyers.

80% of Leadhome’s sellers had to drop their asking price since October 2018, with an average price drop of 5.7% compared to the national average of 9.9%. As evident in the infographic, one in five of Leadhome clients get their asking price or above compared to the industry norm of one in 50. This means Leadhome clients are about 10 times more likely to get their asking price. Leadhome clients also experienced a remarkable improvement of 3.2% higher purchase price than the national average.

Despite persistent macro-economic challenges, Leadhome is still able to sell faster as well as more properties at the listed price because of the data-led approach the agency has adopted. “We use data to inform our property valuations as well as focus on the best service and insight to help our clients get the best possible result for their property,” explains Du Toit. “Leadhome has recognised that clients require more from a real estate agency and we are working hard to assist them to manage this important process.”

Like so many businesses, the real estate market too is evolving as external forces shape and shift how we do business successfully in South Africa. Reverting to old practices is never an option, rather moving forward and continually evolving is what will set us apart. “Our one in five success to date, and the 31% faster selling ability, tells us we are doing something right and gives us peace of mind that our agency is making a difference,” says Du Toit.