By Steve Lauter, Head of Banking for Africa, Wipro Limited

Instead of examining the advantages and disadvantages of digital banking versus traditional banking, it should rather be accepted that digitisation is the direction in which all banks need to move.

These days, it’s imperative that all banks undertake a digital transformation journey to stay relevant and be able to address client expectations. Furthermore, they need to understand that a change in customer behaviour is driving this. Customers no longer want to walk into a branch and transact over the counter. Instead, they wish to have the choice to bank through multiple channels.

Therefore, the transition to digital banking will fundamentally change the way banking is done and banks need to carefully consider the channels that are available to them.

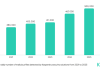

In Sub-Saharan Africa, the growth in mobile adoption has been nothing short of staggering in recent years. On the back of this, the adoption of mobile services has seen a massive uptake of mobile accounts, driving the need for innovation to address financial inclusion. Hence, the development of digital banking platforms is key for any bank to remain competitive in this region.

There are many factors for a bank to consider, especially from an infrastructure perspective. What must be factored in is whether the older technologies and processes that a bank has will be able to meet the demands of digital transformation. In short, banks must decide whether they need to look at overhauling their architecture and technology to support this transformation.

One of the biggest issues pertaining to digitisation in banking is that of change management and how it needs to be undertaken. Change does not only affect the IT side of the organisation, but also involves the business element.

It must be considered that most banks have been in business for well over a hundred years and they are used to a certain way of doing things. Over the years, they have also built in an infrastructure and applications that hold a large amount of information, which also requires processing in the digital era.

Conversely, this is the advantage that new digital banks hold over traditional banks. Digital banks do not have legacy technology or applications, nor a need to change their mindset. They start off as a digital bank. For traditional banks, it’s something that they must adjust to.

The key to digitisation is acceleration or velocity. Most banks across the globe, including South Africa, have undertaken the journey towards digital banking and they are now at various stages of their transformation. These banks have started their digital transformation a few years back through mobile and Internet banking transformation. It has taken these banks at least two to three years to move from a waterfall to an agile/ DevOps approach.

So, the digitisation journey that banks undertake is a long-term one, and they must incorporate internal change management for the initiative to be successful. Eventually, they will get there.

However, IT partners can help accelerate this journey. A partner will bring global experience, high velocity and scale as its value proposition, which will address the critical elements of any transformation.

It’s not that a bank cannot conduct its own digital transformation. Most banks have identified what they want and where they want to go. However, an IT partner can supplement what a bank wants to do and help them through acceleration. That is the main value proposition of bringing a partner on board.

Many banks in the United Kingdom (UK), United States of America (USA) and Europe are undertaking a digitisation journey and IT partners are also helping them to completely transform their engineering teams to deliver high velocity. In addition, partners can often offer training to upskill a bank’s staff through digital academies.

But while the trend in the aforementioned regions is for banks to take on IT partners that can assist with the transformation journey, the situation in South Africa is somewhat different.

Although every bank does have a digital vision in South Africa and has already embarked on this journey, albeit at different stages, the approach of many local banks is to undertake this journey by themselves. Yet, an appropriate technology partner can help them build capacity and accelerate this journey. Imagine the difference between having a few in-house design thinkers versus a full team of specialist skills that are required for this process. Through a partner, these specialist skills are readily available and, in addition, many tools and processes can be brought in to help accelerate the process.

That is not to say that banks must strictly speak and engage with any partner, but they should make use of a partner where there is a definite value that could be gained from the relationship.