In the wake of the pandemic, many face the reality of their meticulous credit records being negatively affected by the whirlwind of last year’s economic instability. Landlords and tenants alike have been affected due to income loss, leading to missed bond payments, downsizing and, unfortunate, if unavoidable evictions.

The challenge we now face is, what can we do? Is it possible to repair your credit record and get that dream rental home? Are your dreams of getting a bond in the future permanently dashed or can they be rescued?

How big is the problem?

Contents

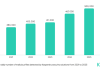

According to Shanaaz Trethewey, CEO of RentMaster, a rental cash flow and collection company with a 20-year track-record: “During 2020, the percentage of total tenants in good standing with their landlords dropped as would be expected. In the first quarter, pre-lockdown saw 81.52% in good standing. When Covid hit that number decreased to 73.5% and while we saw it gradually start to recover with 74.57% in the third and 77.61% in the 4th quarter, the scale of this drop and its impact on the rental income of landlords is undeniable.”

How does one’s credit record get affected and recorded?

It is problematic that to get a bond or rent a home, a good credit score is part of your evaluation and unavoidable, even if the circumstances you had were out of your control. Yet the payments that we make for many years diligently paying our monthly rent could simply not be recorded by many credit bureaus.

There is a specialist rental payment credit bureau, called TPN, that records a tenant’s rental payment data and when combined with other consumer credit data – a more complete consumer profile can be seen. This means that if you pay your rent on time every time, it has the same positive impact on your credit record as any other credit transaction.

“That is why we integrated our debit order collection service into TPN’s lease management software called RentBook, which accurately and safely records how consistently you have paid,” says Trethewey. “This is why private landlords use us – they get the benefit of the rental collection process whilst their tenants have the benefit of payments being recorded.”

What happens if you don’t pay rent?

Because your payment profile is updated monthly, if you stop paying rent, a payment flag will reflect that and impact your credit score.

Your payment data goes to TPN Credit Bureau and this platform provides the user to have any blacklisting loaded into both TPN and TransUnion. To successfully load a blacklisting, a legal process needs to be followed, and RentMaster has been working with landlords for years in ensuring that this is done legally and remains on record until prescription.

We all know that eviction takes place in extreme circumstances, and in some cases through circumstance instead of neglectful behaviour. For anyone that has permission to access your data, the status and time of eviction, the number of months rental not paid, and the total rental owing is visible.

If this is the case, paying your rent on time going forward means that there is an opportunity for you to recover from this status.

“However, unique circumstances, especially in the last year, happen, and we all want to recover from challenging financial circumstances,” she adds. “The best way to do so is to settle all outstanding payments as swiftly as possible and keep paying on time, every time. We have experience in knowing whether tenants are unable to pay, or merely avoiding paying their rent. We manage these collection strategies differently and support all parties along this process.”

Here are Shanaaz’s unbreakable rules to rehab your credit record:

Pay on time, every time.

Accessing credit is extremely difficult once a credit provider sees a non-payment history. No service provider – financial or otherwise – wants to extend terms to a consumer that has been reported not to pay.

Remain within your means.

Re-evaluating your affordability bracket and sticking to it can help remedy both your stress levels and your credit profile over time.

Communicate with your collection agent.

Communicating if your income terms have changed immediately with your landlord and rental agents will allow them to adjust the invoicing and collection in a way that will help everyone cope with the change in a proactive and mutually positive manner.

Ultimately it is about reaching realistic repayment terms and sticking to them.

Keep the administrative stress to a minimum.

Using a debit order helps to take the manual time cost and process out of the payment cycle and helps ensure that you are not subject to interbank processing delays, which are out of your control, that may still land up on record.

Be transparent with your landlord.

Trust is the foundation of all good relationships. Being honest, and consistent, in your agreement will prevent frustration down the line. Showing proof of income and surety, demonstrating your ability to live within your means and prioritising your rental by proactively communicating any issues, all assists in building transactional trust.

The price of having a bad credit record is far more than financial, it is psychological. The debt collectors at RentMaster see it often. When people are desperate our agents encounter a range of emotions from rage to crying which fills them with empathy for their plight. The most challenging situations are when a tenant has avoided the inevitable and eviction has to take place.

For us, it is terrible that it is often a situation which could have been completely diffused if they just engaged and reached an agreement with us sooner.

Rehabilitating your credit record can make your life easier when dealing with service providers, decrease your psychological distress by eliminating the fear of collection calls and creditors give you financial freedom and allow you to continue with your life, knowing that the essentials are taken care of.

Limiting your ability to access a good home or access credit for a vehicle or short-term credit can significantly impact you. Avoidance is definitely not the solution, it escalates the situation, and this just makes it worse and more challenging to rehabilitate your credit in the longer run.