MasterCard recently hosted the African Debit Forum to evaluate and discuss the role of technology in helping banks deliver a seamless consumer experience.

During the one-day event, executives from leading financial institutions discussed the need to harness new technologies such as mobile, and add targeted loyalty offerings to appeal to the emerging digital natives in Africa.

In its effort to build a stronger payment ecosystem across Africa and as part of its Connecting Tomorrow 2018 Forum, Mastercard brought to Barcelona experts to discuss topics such as the strategic role that current accounts and debit cards play in shaping consumer relationships, trends and insights into how African retail banking is evolving, as well as how digital and mobile channels are changing the habits of consumers and what this means for the banking industry.

“Consumers and merchants across Africa are seeking simple, more secure methods to transact,” says Mark Elliott, division president, Mastercard Southern Africa.

“This forum was a perfect opportunity for us to share insights with issuers into how our debit card solutions and innovative mobile technology and payments solutions can displace cash while making it safer and more convenient for people to pay.”

With an estimated 95 per cent of retail transactions still being made in cash in Africa, there remains a great opportunity to drive financial inclusion within the region through innovative technologies, as well as driving debit card adoption and usage.

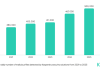

The continent’s banking industry is the second fastest growing of any global region, with a revenue pool expected to grow further at CAGR 8.7% until 2022.

Banking penetration, however, is low with only 300 million banked adults in 2017 (35%), although it is expected to grow to 460 million by 2022 (48%).